Blog

Fire & Burglary Insurance: Why Every Business Needs It

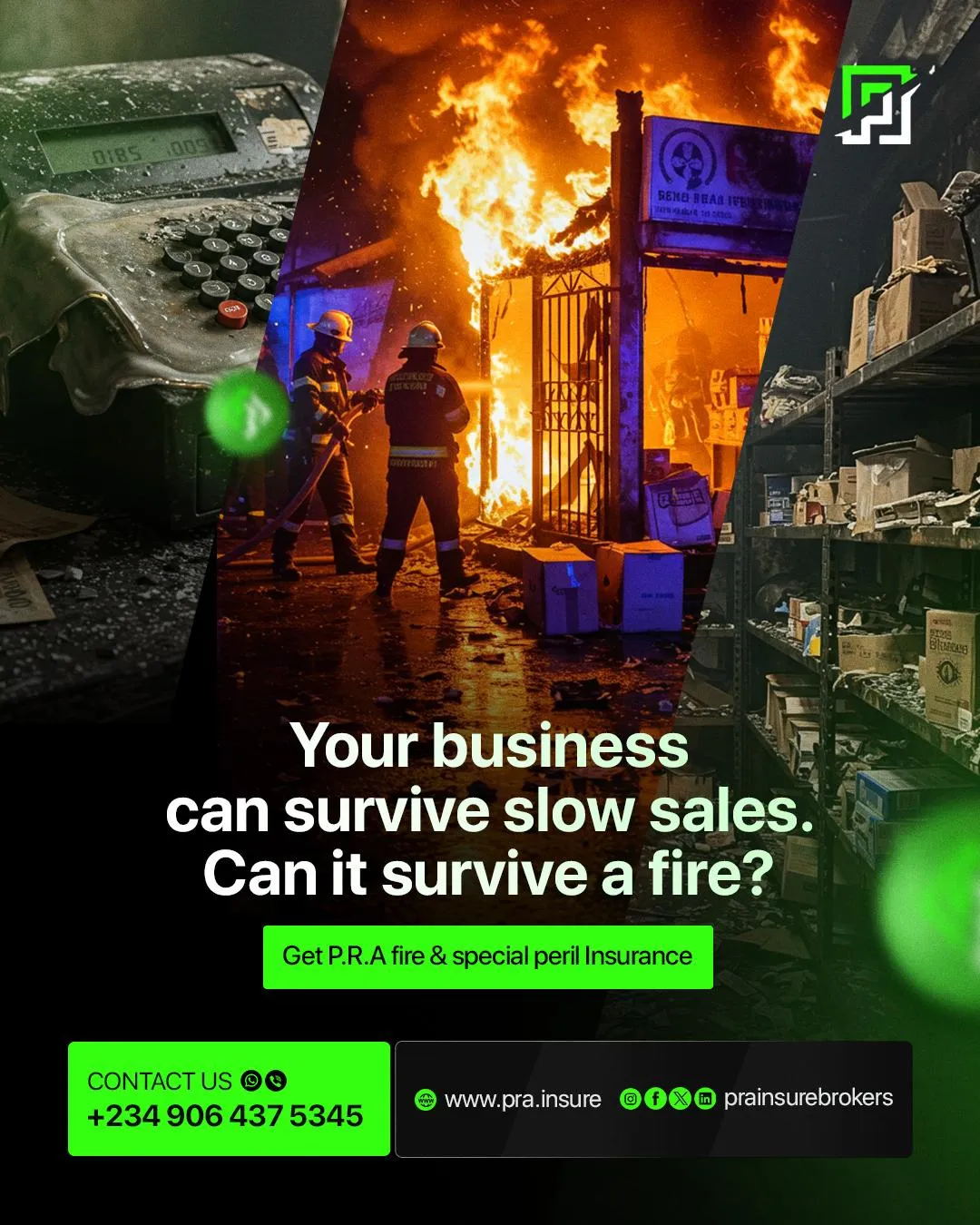

As businesses move forward into a new year, priorities are clear: growth, stability, and smarter risk decisions. Across Nigeria, traders, SMEs, and corporate organisations are restocking, expanding operations, and setting ambitious targets.

But one truth remains unchanged: every business is exposed to fire and burglary risk, regardless of size or industry.

Fire & Burglary Insurance is no longer a “just in case” policy. It is a core part of responsible business management.

Fire & Burglary Risk in Nigerian Business Environments

Many Nigerian businesses operate in environments where risk is heightened:

Heavy reliance on electrical power and generators

High stock volumes are stored in confined spaces

Busy commercial locations with constant movement of people and goods

Fire outbreaks and burglary incidents often occur without warning and can escalate quickly, leaving business owners with little time to respond.

Case Study: The Balogun Market Fire (December)

The December fire incident at Balogun Market, Lagos Island, serves as a recent example of how quickly business risk can become reality.

In a matter of hours:

Shops and warehouses were destroyed

Stock worth millions of naira was lost

Many traders were left without the capital to restart operations

The incident highlighted a critical difference between businesses: those with insurance had a path to recovery, while those without faced total loss.

The Real Impact of Fire and Burglary on Businesses

When fire or burglary occurs, the consequences extend beyond physical damage.

Financial Loss

Stock, equipment, fittings, and business assets can be wiped out instantly, often representing years of investment.

Operational Disruption

Without insurance support, businesses struggle to reopen. Customers drift away, suppliers lose confidence, and cash flow suffers.

Long-Term Setbacks

For many SMEs, one major incident can permanently halt growth or shut down operations entirely.

This is why fire insurance and burglary insurance for businesses in Nigeria are essential, not optional.

What Fire & Burglary Insurance Covers

Fire & Burglary Insurance is designed to protect businesses against losses arising from:

Fire outbreaks due to electrical faults, explosions, or accidents

Damage to stock, equipment, fittings, and business premises

Burglary and theft involving forced or violent entry

With the right coverage in place, businesses can:

Replace damaged or stolen goods

Repair or secure premises

Resume operations with minimal disruption

Insurance does not prevent incidents, but it prevents total business collapse.

Why Every Business Needs This Cover

As businesses pursue growth:

Risk does not wait

Hard work alone is not protection

Expansion without insurance increases exposure

Fire & Burglary Insurance provides:

✔ Financial protection

✔ Business continuity

✔ Confidence to operate in high-risk environments

Preparedness is not fear; it is good business sense.

How PRA Insurance Brokers Supports Business Owners

At PRA Insurance Brokers, we help Nigerian businesses manage risk properly through:

Tailored Fire & Burglary Insurance for traders, SMEs, and corporates

Affordable and flexible premium options

Professional claims support when incidents occur

Expert guidance on coverage structure and risk management

Our focus is simple: helping businesses survive setbacks and recover faster.

Final Thought

The lesson from recent fire incidents is clear: one unexpected event should not erase years of effort.

Fire & Burglary Insurance is not an expense; it is a safeguard for business survival.

At PRA Insurance Brokers, we are committed to helping businesses operate with confidence, resilience, and protection.

📩 Contact PRA Insurance Brokers today to secure your business against fire and burglary risks.

Email: [email protected]

Website: www.pra.insure

Phone: +234 9064 375 345

We are committed to impeccable service and value. PRA focuses on serving the unbanked and underserved market in the Nigerian economy.

Quick links

Services

© PRA Insurance Brokers. 2026. All Rights Reserved.